Irs 2024 Schedule 4 Line 61 – The IRS announced higher inflation adjustments for the 2024 tax year on Thursday. AP It will rise to $29,200, up from $27,700 in 2024 for married couples filing jointly, amounting to a 5.4% bump. . Get your tax years straight Tax years can get confusing. The changes the IRS announced on Thursday are for tax year 2024, for which returns will be due in April 2025. Tax year 2023 will come to a .

Irs 2024 Schedule 4 Line 61

Source : www.amazon.com

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

Amazon.com: Circle Learning Time Center Pocket Chart Calendar Set

Source : www.amazon.com

Schwartz Insurance Group | Louisville KY

Source : m.facebook.com

Amazon.: 2023 Latest Alaska Labor Law Poster State, Federal

Source : www.amazon.com

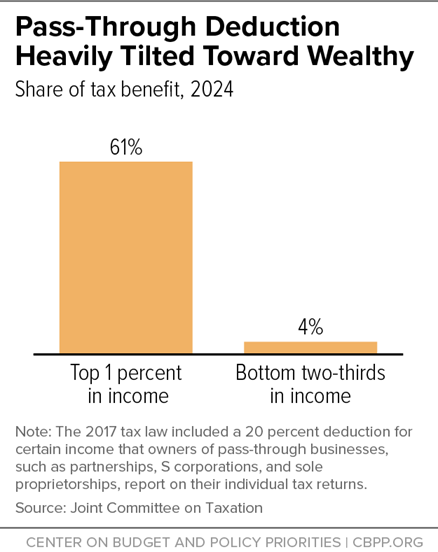

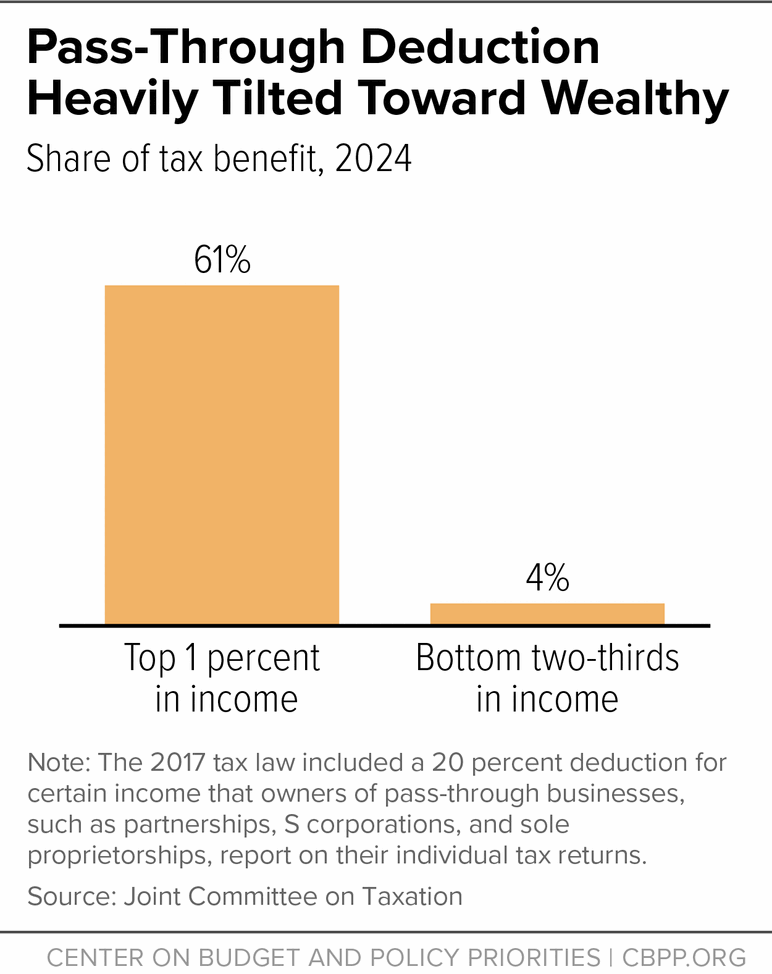

Pass Through Deduction Heavily Tilted Toward Wealthy | Center on

Source : www.cbpp.org

Amazon.: 2024 Latest Kansas Labor Law Poster : State, Federal

Source : www.amazon.com

Repealing Flawed “Pass Through” Deduction Should Be Part of

Source : www.cbpp.org

Amazon.: 2024 Latest Florida Labor Law Poster State, Federal

Source : www.amazon.com

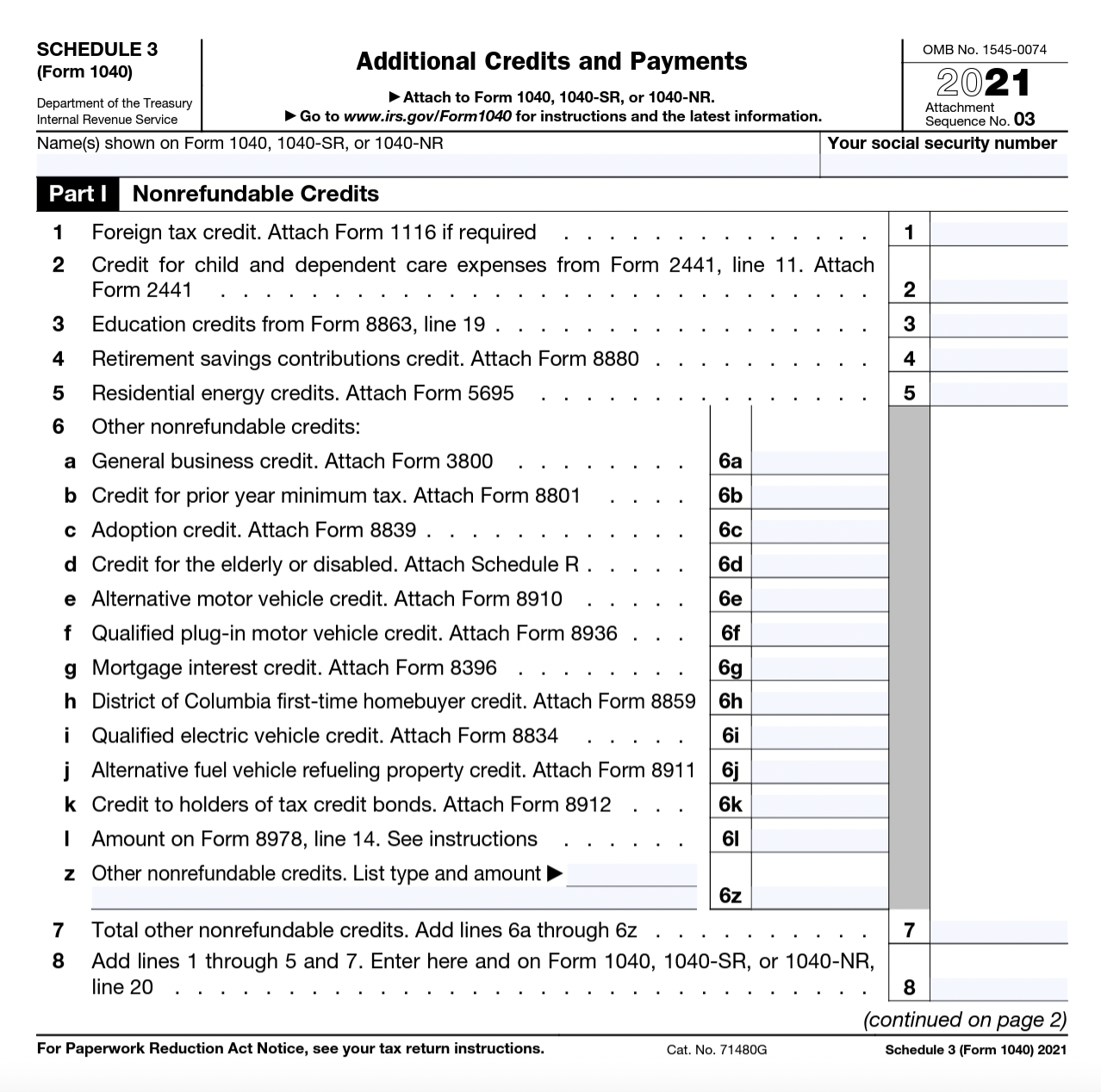

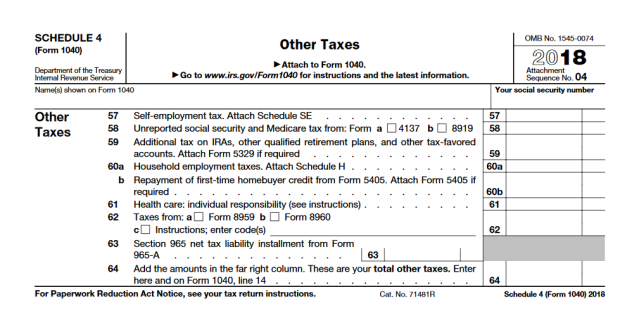

IRS Schedule 4: Do You Owe These 7 Extra Taxes?

Source : finance.yahoo.com

Irs 2024 Schedule 4 Line 61 Amazon.: 2024 Latest South Carolina Labor Law Poster State : The IRS on Thursday announced higher federal income tax brackets and standard deductions for 2024. The agency has boosted the income thresholds for each bracket, applying to tax year 2024 for . The IRS has announced the annual inflation adjustments for the year 2024, including tax rate schedules, tax tables and cost-of-living adjustments. These are the official numbers for the tax year .